Tax and Accounting

in the United States

We offer customized solutions to meet your US Accounting and Tax needs.

- Tailored solutions

Who Can Benefit from Our Tax

and Accounting Services?

We provide strategic tax and accounting solutions to enhance financial compliance and maximize tax efficiency in the United States.

Individuals and Taxpayers

Small Businesses and Entrepreneurs

Real Estate Investors and Owners

- Services

Our

Accounting

and Tax Solutions

Our experts are dedicated to providing you with comprehensive advice

on all aspects of accounting services in the United States.

-

Individuals and Taxpayers

-

Small Businesses and Entrepreneurs

-

Real Estate Investors and Owners

-

Other Services

- Tax Guidance for Individual Taxpayers in the US (both residents and non-residents);

- Evaluation of various reasons that lead to a tax return

- Analysis of possible tax scenarios in the US;

- Estate Tax - Gifts Tax

- Foreign US Tax credits.

- Tax impact on individual taxes.

- Annual Tax Returns

- Tax regularization of US citizens - Streamline process.

- Tax advice and guidance on the creation of new companies;

- Evaluation of tax treatments in companies;

- Analysis of tax structures and impacts of entities;

- Hiring of employees and/or contractors, Collection of sales taxes.

- Accounting, issuance of financial statements.

- Sales Tax and Federal Reports.

- Tax advice and guidance on real estate investments;

- Investment analysis for efficient tax treatment;

- Tax advice before, during and after the investment;

- Tax assessment on possible transfers of ownership in investments;

- FIRPTA WITHHOLDING Tax and Recovery of Withheld Funds.

- Advice on Annual Tax Returns;

- Review and analysis of previously filed tax returns;

- Review of Letters Issued by the IRS;

- Fincen Report (Beneficial Ownership Information - BOI);

- BEA (Bureau of Economic Analysis).

- The Right Path

Efficient accounting for

sustainable growth

Power your path to financial success with agile and effective accounting.

Maryana Di Prisco

Tax and Accounting Expert

Small Business Finance

Specialists

We have a highly trained team to address all aspects of our services in a comprehensive manner

Frequently Asked Questions

We accept payments through PayPal, a secure and reliable platform for online transactions. When making an immigration inquiry in the United States, you can pay for our services using this option.

We offer our Tax Accounting services in several languages. You can make your enquiry in the language that is most comfortable for you. Our professionals are trained to answer questions in English, Spanish and other languages, thus ensuring fluid and effective communication.

We offer advice on a wide range of tax accounting issues in the United States. Our team of experts is ready to answer queries related to tax returns, tax planning, tax compliance, optimization of tax deductions and credits, as well as other tax accounting issues. If you have any questions or concerns about your taxes or need assistance with any aspect of your tax situation, please do not hesitate to contact us. We are here to help.

Currently, our tax accounting consultation service is conducted virtually to provide you with convenience and access from any location. We use the Calendly platform to schedule and program our consultations. Once the consultation is scheduled, we will send you a link to join the video call through an online communication platform. This way, you can receive expert advice from the comfort of your home. We are committed to offering you a convenient and efficient service to effectively address your tax needs.

The length of a tax accounting consultation can vary depending on the complexity of your financial situation and the questions you have. Generally, our consultations last approximately 30 minutes to 45 minutes, but our main goal is to take the time necessary to address all of your concerns and provide you with the best advice possible. We are committed to providing you with personalized and thorough attention to ensure that you receive the right guidance for your tax needs.

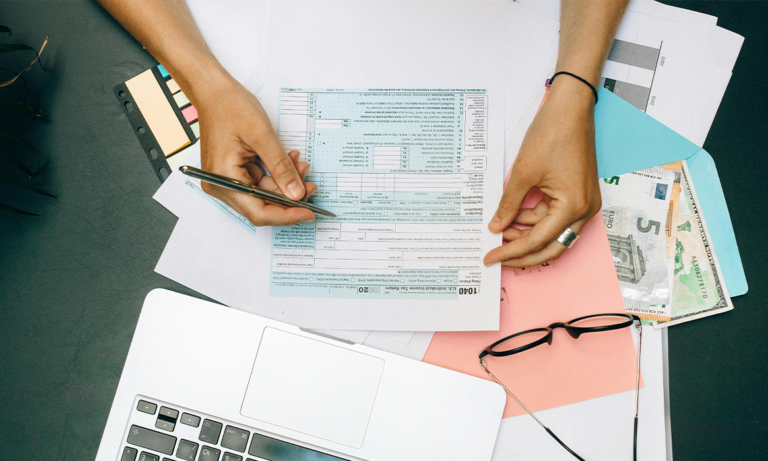

To get the most out of your tax accounting consultation, it is a good idea to have any relevant documentation related to your finances and tax situation on hand. This may include previous tax returns, W-2 forms, 1099 forms, or any other documents related to your income and expenses. It is also helpful to have information about any possible tax deductions or credits you may be entitled to. By providing this documentation during your consultation, we will be able to better understand your financial situation and provide you with more accurate and personalized guidance on how to optimize your tax situation.

Our team of consultants is comprised of professionals with extensive experience in U.S. tax matters. They are familiar with tax laws and regulations and stay up-to-date on changes in tax policies. Their expertise covers a variety of areas, including individual and business tax return preparation, tax planning, tax compliance, tax problem resolution, and optimization of tax deductions and credits, among others. We are committed to providing you with expert and personalized advice on all aspects of tax accounting.

The privacy and confidentiality of your personal data is of utmost importance to us. We comply with all applicable data protection laws and regulations and guarantee that the information provided during the consultation will be kept strictly confidential and will only be used for the purpose of providing the immigration consultation service. We are committed to protecting your data and using it only in accordance with your needs and preferences. You can always trust that your data is safe with us.

Request a

meeting now

Our team is ready to advise you